During this pandemic crisis, a lot of workers were laid off, some were permanently removed from work, and presently unemployed. Many businesses had closed and went bankrupt while other establishments are still struggling to recover their losses. A lot of people seek opportunities and one of their alternatives is to go online and make money to survive. Most of them go to freelancing, online selling, e-commerce business, and any form of online business that they can try.

Amidst the COVID 19 Pandemic, the Republic of the Philippines Department of Finance-Bureau of Internal Revenue received and signed a memorandum that any business forms or transactions through Electronic Media and Platforms and to unregistered Businesses must ensure to register pursuant to the provision of Section 236 of the Tax Code. In simple terms, Online Sellers, Freelancers, and any E-commerce businessmen need to register their businesses this time.

This Revenue Memorandum Circular No. 60-2020 was received by BIR on June 10, 2020, at 2:30pm. Those who will register their businesses not later than July 31, 2020, shall not have the penalty for the late registration. All those who will not register, comply, update their business transactions, and don't declare due taxes shall be imposed with applicable penalties.

To those newly registered businesses, and existing registrants need to comply with the provisions of the Tax Code such as:

1. Issuance of Registered Sales Invoice or Official Receipt

2. Keeping of Registered Books of Accounts and other accounting records of business transactions.

3. Withholding of taxes, as applicable;

4. Filing of required tax returns; and

5. Payment of correct taxes due on time.

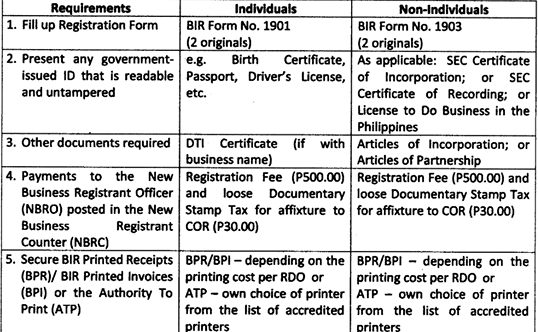

The Certificate of Registration shall be issued upon compliance with these requirements:

According to CNN Philippines on June 11, 2020; the Malacanang clarified that not all online sellers will pay taxes but still required to register in BIR. As per Mr. Chua, annual earnings of 250,000 and below are not subjected to pay taxes ( Tax Reform for Acceleration and Inclusion Act) but those earning 250,000 pesos and above must pay their taxes.

The Presidential Spoke Person Harry Roque said that the funds for the COVID 19 are from the BIR and Bureau of Customs and due to the increasing demand for the COVID budget, the government will continue to find ways to increase the intake of taxes.

Our government really needs taxes to operate and fight the COVID 19, but BIR is delayed to collect this year due to extended due dates for those affected businesses. However, some business owners especially small businesses are still chasing their losses and still need to pay a bunch of bills and taxes, it is really saddening to see the situation where everyone is struggling to cope up with those collections needed to be paid on time for the next coming months.

******************************************************************************

REFERENCES CITE:

CNN PHILIPPINES STAFF.2020.Palace clarifies: Online Seller earning below Php 250,000 a year won't need to pay taxes but must register with BIR. Retrieved on July 11, 2020, from https://www.cnnphilippines.com/news/2020/6/11/online-sellers-Malacanang-clarification-BIR.html

BUREAU OF INTERNAL REVENUE. 2020. Revenue Memorandum Circular no. 60-2020. Retrieved on July 11, 2020, from https://www.bir.gov.ph/index.php/revenue-issuances/revenue-memorandum-circulars/2020-revenue-memorandum-circulars.html

No comments:

Post a Comment